“Building good credit” is one of those things adults are expected to do. It’s important when you want to do something like rent a place to live, get a mortgage or apply for a loan. Unfortunately, most people also get their first credit card at a young age, and not everyone knows what it means to be smart about credit. Basically, we all have to take calculus in high school, but a personal finance class would probably be a lot more useful for most of us.

Canadian financial start up, Lendful, provides personal loans to people with a good track record of using credit responsibly. The process is a lot simpler than going to through a bank and as their website states, they “want to offer you the means and the time to build your lives, not the banks’ bottom lines.” They also want to shed more light on the dangers of credit cards.

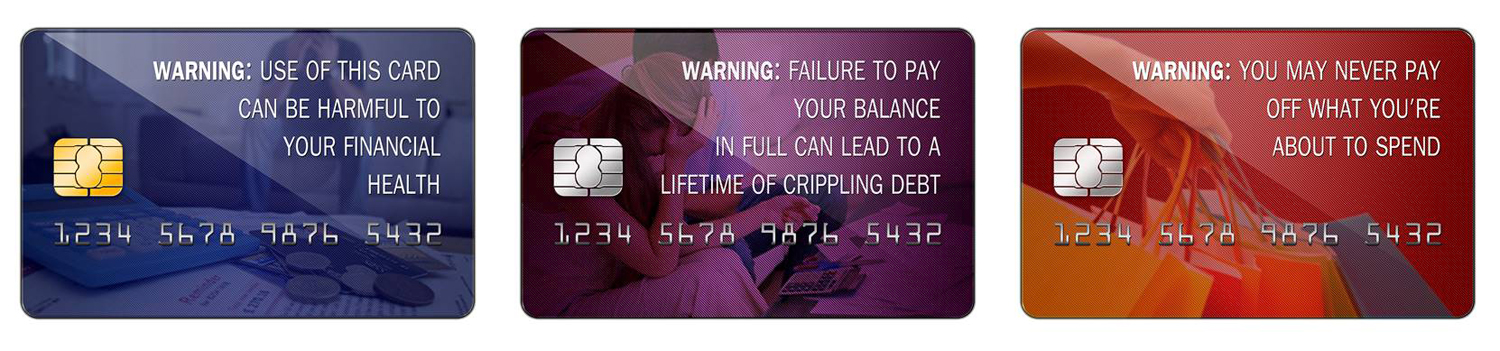

Lendful is proposing that all banks should be required to include a warning on their credit cards. They’ve started a petition on change.org that they intend to send to all the biggest banks in Canada once they’ve collected enough signatures. According to Lendful CEO Alex Benjamin, “We have warnings on cigarettes, we now have calorie counts on fast food, but when it comes to credit cards, there is literally nothing out there warning Canadians about the potential pitfalls associated with our ubiquitous ‘buy now, pay later’ mentality. Canadians are drowning in debt, and credit cards account for a huge portion of this issue. It needs to stop.”

Possible warnings could include, “ Use of this card can be harmful to your financial health”, “Failure to pay your balance in full can lead to a lifetime of crippling debt” and “You may never pay off what you’re about to spend”. Just like the pictures of damaged lungs, rotting teeth and sick children on cigarette packs, these warnings aren’t trying to sugarcoat the risks of spending money you don’t have.

The question is, will it make a difference? There will always be people who see no problem with having three credit cards all hovering around the maxed out mark at all times, but for others, a little reminder just before they’re about to swipe, tap or click buy at an online store might make them think twice.

Benjamin also points out, “Like Big Tobacco, the credit card companies are targeting young Canadians, billing their products as a way to establish good credit, but neglecting to equip them with the information to ensure they use it wisely. There needs to be a level of accountability. If your product can inflict harm, it is your duty to educate your customers.” Credit cards are a product banks are selling to people so of course they don’t want to do anything that will hurt their bottom line. But that doesn’t mean they shouldn’t have to.

Some people will always learn the hard way, but overall if can’t hurt to remind people that credit isn’t real money. If you don’t have a way to pay off what you’re spending, you shouldn’t be spending it. If a warning on a credit card has the potential to help people remember that, then why not?